Scenario 10-2

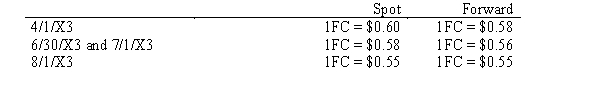

On 4/1/X3, a U.S. Company commits to sell a piece of equipment to a French customer. At that time, the U.S. company enters into a forward contract to sell foreign currency on 8/1/X3 (120 days) . Delivery will take place 7/1/X3 with payment due on 8/1/X3. The fiscal year end for the company is 6/30/X3. The sales price of the equipment is 200,000 Euros. Various exchange rates are as follows:

Discount rate is 12%.

Discount rate is 12%.

-Refer to Scenario 10-2. What is the value of Forward Contract Payable-FC on 6/30?

A) 112,000

B) 112,040

C) 116,000

D) none of the above

Correct Answer:

Verified

Q20: A United States based company that has

Q30: Current disclosure requires users of hedging instruments

Q31: Scenario 10-2

On 4/1/X3, a U.S. Company commits

Q31: Which of the following statements is not

Q33: Hugh, Inc. purchased merchandise for 300,000 FC

Q35: Happ, Inc. agreed to purchase merchandise from

Q36: The time value of an option is

Q37: In the accounting for forward exchange contracts,

Q38: Which of the following is not true

Q59: A U.S. Corp. purchased a computer from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents