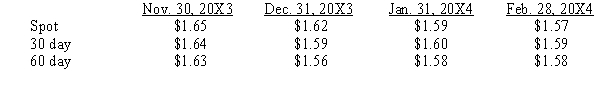

Happ, Inc. agreed to purchase merchandise from a British vendor on November 30, 20X3. The goods will arrive on January 31, 20X4 and payment of 100,000 British pounds is due February 28, 20X4. On November 30, 20X3, Happ signed an agreement with a foreign exchange broker to buy 100,000 British pounds on February 28, 20X4. Exchange rates to purchase 1 British pound are as follows:  Because of this commitment hedge, Happ, Inc. will record the merchandise at what value when it arrives in January?

Because of this commitment hedge, Happ, Inc. will record the merchandise at what value when it arrives in January?

A) $165,000

B) $164,000

C) $160,000

D) $159,000

Correct Answer:

Verified

Q20: A United States based company that has

Q30: Current disclosure requires users of hedging instruments

Q31: Scenario 10-2

On 4/1/X3, a U.S. Company commits

Q33: Hugh, Inc. purchased merchandise for 300,000 FC

Q34: Scenario 10-2

On 4/1/X3, a U.S. Company commits

Q36: The time value of an option is

Q37: In the accounting for forward exchange contracts,

Q38: Which of the following is not true

Q55: The accounting treatment given a cash flow

Q59: A U.S. Corp. purchased a computer from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents