Lion Corporation, a U.S. firm, entered into several foreign currency transactions during the year. Determine the effect of each transaction on net income for that current accounting year only. Bear has a June 30 year end.

Required:

a.

On January 15, Lion sold $30,000 (Canadian) in merchandise to a Canadian firm, to be paid for on February 15 in Canadian dollars. Canadian dollars were worth $0.85 (U.S.) on January 15 and $0.82 (U.S.) on February 15.

b.

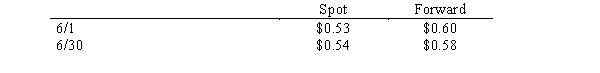

On June 1, Lion purchased and received a computer costing 100,000 euros from a German firm. Bear paid for the computer on August 1. On June 1, to reduce exchange risks, Lion purchased a contract to buy 100,000 marks in 60 days. Exchange rates are as follows:

Discount rate = 6%

Discount rate = 6%

c.

On June 1, Lion purchased an option to sell 100,000 FC in 60 days to hedge a forecasted sale to a customer. The option sold for a premium of $6,500 and a strike price of $1.20. The value of the option 6/30 was $12,500. The spot rate on June 1 was $1.19 and $1.25 on June 30.

Correct Answer:

Verified

Q51: On November 1, 20X2, a calendar-year investor

Q52: On November 1, 20X1, a U.S. company

Q53: Explain how the risks differ for holders

Q54: Zerlie's Imports purchased automotive parts from a

Q55: On November 1, 20X8 Desket, Inc. a

Q56: Wolters Corporation is a U.S. corporation that

Q58: Red & Blue Company, a U.S. corporation,

Q60: Blue & Green, Inc. purchased merchandise

Q63: For a hedge on an exposed position,

Q74: Describe the risks and uncertainty a U.S.company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents