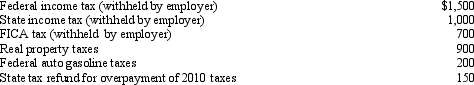

During 2011,Geraldine,a salaried taxpayer,paid the following taxes which were not incurred in connection with a trade or business:  What amount can Geraldine claim for 2011 as an itemized deduction for the taxes paid,assuming she elects to deduct state and local taxes?

What amount can Geraldine claim for 2011 as an itemized deduction for the taxes paid,assuming she elects to deduct state and local taxes?

A) $4,150

B) $1,950

C) $1,000

D) $1,750

E) $1,900

Correct Answer:

Verified

Q1: Hortense had adjusted gross income in 2011

Q4: William had a bad year.First,his house was

Q5: Please choose the true statement.

A)A charitable contribution

Q6: Polly is a telephone service person employed

Q7: During the current year,Carl and Jill incurred

Q8: Which of the following is true of

Q9: Which of the following taxes are deductible

Q10: Which of the following expenses are deductible

Q11: Which of the following is deductible as

Q15: Which of the following is not deductible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents