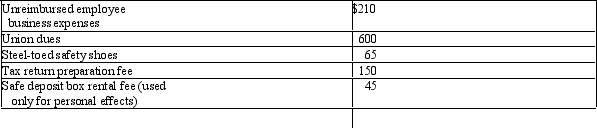

Polly is a telephone service person employed by a telephone repair firm.During 2011,she paid the following miscellaneous expenses:  If Polly were to itemize her deductions in 2011,what amount could she claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

If Polly were to itemize her deductions in 2011,what amount could she claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

A) $1,070

B) $1,025

C) $960

D) $875

E) $810

Correct Answer:

Verified

Q1: Hortense had adjusted gross income in 2011

Q2: During 2011,Geraldine,a salaried taxpayer,paid the following taxes

Q4: William had a bad year.First,his house was

Q5: Please choose the true statement.

A)A charitable contribution

Q7: During the current year,Carl and Jill incurred

Q8: Which of the following is true of

Q9: Which of the following taxes are deductible

Q10: Which of the following expenses are deductible

Q11: Which of the following is deductible as

Q15: Which of the following is not deductible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents