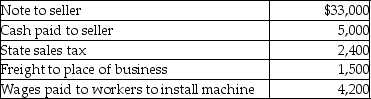

Dennis purchased a machine for use in his business.Mr.Dennis' costs in connection with this purchase were as follows:  What is the amount of Mr.Dennis' basis in the machine?

What is the amount of Mr.Dennis' basis in the machine?

A) $33,000

B) $40,400

C) $41,900

D) $46,100

Correct Answer:

Verified

Q11: Antonio owns land held for investment with

Q18: All realized gains and losses are recognized

Q23: Rachel holds 110 shares of Argon Mutual

Q24: In a basket purchase,the total cost is

Q25: Edward purchased stock last year as follows:

Q27: For purposes of calculating depreciation,property converted from

Q31: With regard to taxable gifts after 1976,no

Q36: Taj Corporation has started construction of a

Q37: Kathleen received land as a gift from

Q40: If the stock received as a nontaxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents