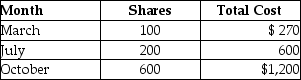

Edward purchased stock last year as follows:  In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

A) $160.

B) $184.

C) $216.

D) $240.

Correct Answer:

Verified

Q18: All realized gains and losses are recognized

Q23: Rachel holds 110 shares of Argon Mutual

Q24: Dennis purchased a machine for use in

Q24: In a basket purchase,the total cost is

Q27: For purposes of calculating depreciation,property converted from

Q27: Empire Corporation purchased an office building for

Q31: With regard to taxable gifts after 1976,no

Q36: Taj Corporation has started construction of a

Q37: Kathleen received land as a gift from

Q40: If the stock received as a nontaxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents