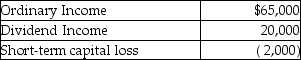

Bryan Corporation,an S corporation since its organization,is owned entirely by Mr.Bryan.The corporation uses a calendar year as its taxable year.Mr.Bryan paid $120,000 for his Bryan stock when the corporation was formed on January 1 of this year.For this year,Bryan Corporation reported the following results:  Distributions of $40,000 were made during the year.What is the basis of Mr.Bryan's stock on December 31?

Distributions of $40,000 were made during the year.What is the basis of Mr.Bryan's stock on December 31?

A) $163,000

B) $165,000

C) $203,000

D) $205,000

Correct Answer:

Verified

Q123: An S corporation distributes land to its

Q124: S corporation shareholders who own more than

Q125: Tonya is the 100% shareholder of a

Q126: Stephanie owns a 25% interest in a

Q126: Stephanie owns a 25% interest in a

Q128: For each of the following independent cases

Q129: A new corporation is formed on January

Q132: A shareholder sells his S corporation stock

Q140: An S corporation distributes land with a

Q146: Shelley owns a 25% interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents