Tonya is the 100% shareholder of a corporation established five years ago.It has always been an S corporation.After adjustment for this year's corporate income,but before taking distributions into account,Tonya has a $50,000 stock basis.The corporation pays Tonya a $60,000 cash distribution.As a result of this distribution,Tonya will have an ending stock basis and recognize income of

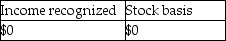

A)

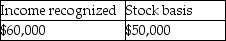

B)

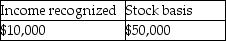

C)

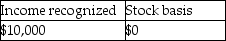

D)

Correct Answer:

Verified

Q118: The corporate built-in gains tax does not

Q121: Empire Corporation has operated as a C

Q123: An S corporation distributes land to its

Q124: S corporation shareholders who own more than

Q126: Stephanie owns a 25% interest in a

Q126: Stephanie owns a 25% interest in a

Q127: Bryan Corporation,an S corporation since its organization,is

Q128: For each of the following independent cases

Q129: A new corporation is formed on January

Q140: An S corporation distributes land with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents