Stephanie owns a 25% interest in a qualifying S corporation.Stephanie's basis in the stock was $40,000 at the beginning of the year.Stephanie made no capital contributions and received no distributions during the year.Stephanie loaned the S corporation $10,000 this year.The S corporation incurred a $240,000 ordinary loss this year.Stephanie's deduction and carryover of the unused loss are

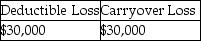

A)

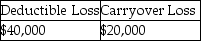

B)

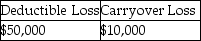

C)

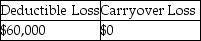

D)

Correct Answer:

Verified

Q121: Empire Corporation has operated as a C

Q123: An S corporation distributes land to its

Q124: S corporation shareholders who own more than

Q125: Tonya is the 100% shareholder of a

Q126: Stephanie owns a 25% interest in a

Q127: Bryan Corporation,an S corporation since its organization,is

Q128: For each of the following independent cases

Q129: A new corporation is formed on January

Q140: An S corporation distributes land with a

Q146: Shelley owns a 25% interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents