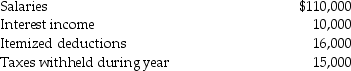

Brad and Angie had the following income and deductions during 2016:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Organizing a corporation as an S Corporation

Q57: Flow-through entities do not have to file

Q63: Chris,a single taxpayer,had the following income and

Q67: Fireball Corporation is an S corporation.Leyla owns

Q70: AB Partnership earns $500,000 in the current

Q73: Limited liability companies may elect to be

Q75: Limited liability company members (owners)are responsible for

Q77: All of the following are classified as

Q79: Which of the following is not a

Q79: What is an important aspect of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents