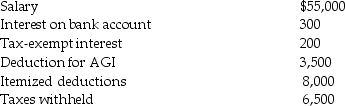

Chris,a single taxpayer,had the following income and deductions during 2016:

Calculate Chris's tax liability due or refund.

Calculate Chris's tax liability due or refund.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: Which of the following is not a

Q58: Jose dies in the current year and

Q60: Jillian,a single individual,earns $230,000 in 2016 through

Q62: Firefly Corporation is a C corporation.Freya owns

Q67: Fireball Corporation is an S corporation.Leyla owns

Q68: Brad and Angie had the following income

Q75: Limited liability company members (owners)are responsible for

Q79: What is an important aspect of a

Q79: Which of the following is not a

Q80: All of the following statements are true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents