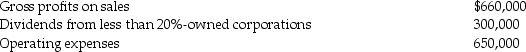

Carter Corporation reports the following results for the current year:

a) What is Carter Corporation's taxable income for the current year?

a) What is Carter Corporation's taxable income for the current year?

b) How would your answer to Part (a) change if Carter's operating expenses are instead $700,000?

c) How would your answer to Part (a) change if Carter's operating expenses are instead $760,000?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: Bright Corporation purchased residential real estate five

Q63: Little Corporation uses the accrual method of

Q70: During the year, Soup Corporation contributes some

Q79: Prince Corporation donates inventory having an adjusted

Q82: Courtney Corporation had the following income and

Q83: Identify which of the following statements is

Q86: Glacier Corporation,a large retail sales company,has a

Q86: Jackel, Inc. has the following information for

Q88: Bermuda Corporation reports the following results in

Q100: Delux Corporation,a retail sales corporation,has a taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents