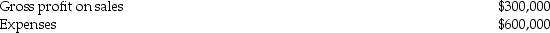

Courtney Corporation had the following income and expenses for the tax year:

Dividends received from less-than-20%-

Dividends received from less-than-20%-

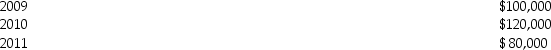

Courtney had taxable income for the past three years of:

Courtney had taxable income for the past three years of:

a) Determine the corporation's NOL for the current year.

a) Determine the corporation's NOL for the current year.

b) Determine the amount of NOL carried back to each preceding tax year and the amount of NOL, if any, available as a carryforward.

Correct Answer:

Verified

Q55: Bright Corporation purchased residential real estate five

Q63: Little Corporation uses the accrual method of

Q70: During the year, Soup Corporation contributes some

Q77: Grant Corporation is not a large corporation

Q79: Prince Corporation donates inventory having an adjusted

Q83: Identify which of the following statements is

Q83: Carter Corporation reports the following results for

Q86: Glacier Corporation,a large retail sales company,has a

Q86: Jackel, Inc. has the following information for

Q100: Delux Corporation,a retail sales corporation,has a taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents