Mirabelle contributed land with a $5,000 basis and a $9,000 FMV to MS Partnership four years ago. This year the land is distributed to Sergio, another partner in the partnership. At the time of distribution, the land had a $12,000 FMV. How much gain should Mirabelle and Sergio recognize?

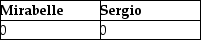

A)

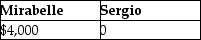

B)

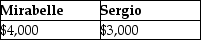

C)

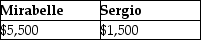

D)

Correct Answer:

Verified

Q2: If a distribution occurs within _ years

Q10: In a current distribution, the partner's basis

Q13: Becky has a $24,000 basis in her

Q20: Mirabelle contributed land with a $5,000 basis

Q25: For Sec. 751 purposes, "substantially appreciated inventory"

Q38: Under Sec. 751, unrealized receivables include potential

Q49: A partner's holding period for a partnership

Q57: A partner can recognize gain, but not

Q75: When a retiring partner receives payments that

Q76: Under the check-the-box rules, an LLC with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents