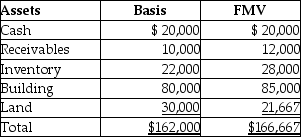

The LM Partnership terminates for tax purposes on July 15 when Latasha sells her 60% capital and profits interest to Zoe for $100,000. The partnership has no liabilities, and its assets at the time of termination are as follows:  Marika, a 40% partner in the LM Partnership, has a $64,800 basis in her partnership interest (outside basis) at the time of the termination. She has held her LM Partnership interest for three years at the time of the termination. The bases of Marika and Zoe in the new LM Partnership is:

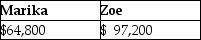

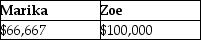

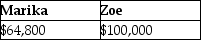

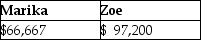

Marika, a 40% partner in the LM Partnership, has a $64,800 basis in her partnership interest (outside basis) at the time of the termination. She has held her LM Partnership interest for three years at the time of the termination. The bases of Marika and Zoe in the new LM Partnership is:

A)

B)

C)

D)

Correct Answer:

Verified

Q27: Two years ago,Tom contributed investment land with

Q32: Last year, Cara contributed investment land with

Q39: Jerry has a $50,000 basis for his

Q68: What is the character of the gain/loss

Q81: Sean, Penelope, and Juan formed the SPJ

Q82: Han purchases a 25% interest in the

Q84: The AB, BC, and CD Partnerships merge

Q87: What are some advantages and disadvantages of

Q101: The STU Partnership, an electing Large Partnership,

Q103: What are the advantages of a firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents