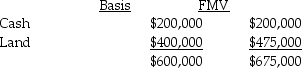

Sean, Penelope, and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000. In the following year, Penelope sold her one-third interest to Pedro for $225,000. At the time of the sale, the SPJ partnership had the following balance sheet:

Shortly after Pedro became a partner, SPJ sold the land for $475,000. What are the tax consequences of the sale to Pedro and the partnership (1) assuming there is no Section 754 election in place, and (2) assuming the partnership has a valid Section 754 election?

Shortly after Pedro became a partner, SPJ sold the land for $475,000. What are the tax consequences of the sale to Pedro and the partnership (1) assuming there is no Section 754 election in place, and (2) assuming the partnership has a valid Section 754 election?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Two years ago,Tom contributed investment land with

Q32: Last year, Cara contributed investment land with

Q39: Jerry has a $50,000 basis for his

Q41: What is included in the definition of

Q68: What is the character of the gain/loss

Q79: The LM Partnership terminates for tax purposes

Q87: What are some advantages and disadvantages of

Q101: The STU Partnership, an electing Large Partnership,

Q103: What are the advantages of a firm

Q107: What is an electing large partnership? What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents