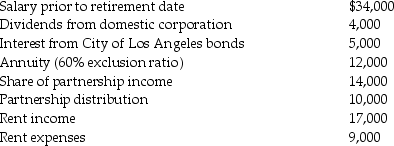

Jeannie,a single taxpayer,retired during the year,to take over the management of some rental property.She had the following items of income and expense:  What is Jeannie's adjusted gross income for the year?

What is Jeannie's adjusted gross income for the year?

Correct Answer:

Verified

Q111: Betty is a single retiree who receives

Q125: Edward is considering returning to work part-time

Q127: Gwen's marginal tax bracket is 25%.Gwen pays

Q131: Marisa and Kurt divorced in 2013.Under the

Q131: Daniel plans to invest $20,000 in either

Q134: On April 1,2015,Martha,age 67,begins receiving payments of

Q135: Kevin is a single person who earns

Q138: Buzz is a successful college basketball coach.In

Q884: Rocky owns The Palms Apartments. During the

Q911: Marcia and Dave are separated and negotiating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents