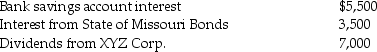

Kevin is a single person who earns $70,000 in salary for 2015 and has other income from a variety of investments,as follows:  Kevin received tax refunds when he filed his 2014 tax returns in April of 2015.His federal refund was $600 and his state refund was $300.Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2014 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2015 return.

Kevin received tax refunds when he filed his 2014 tax returns in April of 2015.His federal refund was $600 and his state refund was $300.Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2014 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2015 return.

Compute Kevin's taxable income for 2015.

Correct Answer:

Verified

Q121: "Gross income" is a key term in

Q125: Edward is considering returning to work part-time

Q127: Gwen's marginal tax bracket is 25%.Gwen pays

Q131: Marisa and Kurt divorced in 2013.Under the

Q131: Daniel plans to invest $20,000 in either

Q133: Jeannie,a single taxpayer,retired during the year,to take

Q134: On April 1,2015,Martha,age 67,begins receiving payments of

Q138: Buzz is a successful college basketball coach.In

Q884: Rocky owns The Palms Apartments. During the

Q911: Marcia and Dave are separated and negotiating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents