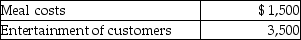

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be attended by many potential customers. During the week of the convention, Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

A) $500 from AGI

B) $500 for AGI

C) $2,000 from AGI

D) $2,000 for AGI

Correct Answer:

Verified

Q31: Gayle,a doctor with significant investments in the

Q58: Matt is a sales representative for a

Q60: Sarah incurred employee business expenses of $5,000

Q64: Joe is a self-employed tax attorney who

Q69: Shane, an employee, makes the following gifts,

Q70: Rajiv, a self-employed consultant, drove his auto

Q71: Chelsea, who is self-employed, drove her automobile

Q72: Edward incurs the following moving expenses:

Q77: The following individuals maintained offices in their

Q80: In which of the following situations is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents