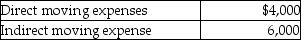

Edward incurs the following moving expenses:  The employer reimburses Edward for the full $10,000. What is the amount to be reported as income by Edward?

The employer reimburses Edward for the full $10,000. What is the amount to be reported as income by Edward?

A) $0

B) $4,000

C) $6,000

D) $10,000

Correct Answer:

Verified

Q31: Gayle,a doctor with significant investments in the

Q31: Norman traveled to San Francisco for four

Q60: Sarah incurred employee business expenses of $5,000

Q68: Steven is a representative for a textbook

Q69: Shane, an employee, makes the following gifts,

Q70: Rajiv, a self-employed consultant, drove his auto

Q71: Chelsea, who is self-employed, drove her automobile

Q74: Bill obtained a new job in Boston.

Q75: All of the following may deduct education

Q76: Jordan, an employee, drove his auto 20,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents