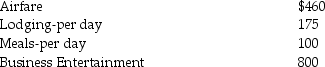

Richard traveled from New Orleans to New York for both business and vacation. He spent 4 days conducting business and some days vacationing. He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor), assuming Richard is an employee and is not reimbursed, under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor), assuming Richard is an employee and is not reimbursed, under the following two circumstances?

a. He spends three days on vacation, in addition to the business days.

b. He spends six days on vacation, in addition to the business days.

Correct Answer:

Verified

Q71: All of the following characteristics are true

Q87: Tessa is a self-employed CPA whose 2014

Q97: Which of the following statements regarding Coverdell

Q97: Martin Corporation granted a nonqualified stock option

Q101: Feng,a single 40 year old lawyer,is covered

Q103: Sarah purchased a new car at the

Q107: Tyne is a 48-year-old an unmarried taxpayer

Q107: Rita, a single employee with AGI of

Q116: H (age 50)and W (age 48)are married

Q119: Mirasol Corporation granted an incentive stock option

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents