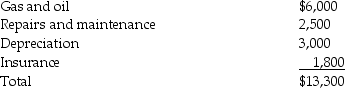

Sarah purchased a new car at the beginning of the year. She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2014 for employment-related business miles. She incurs the following expenses related to both business and personal use:

She also spent $200 on parking and tolls that were related to business. During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business. During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: All of the following characteristics are true

Q82: All of the following are true with

Q87: Tessa is a self-employed CPA whose 2014

Q97: Which of the following statements regarding Coverdell

Q101: Feng,a single 40 year old lawyer,is covered

Q102: Richard traveled from New Orleans to New

Q107: Tyne is a 48-year-old an unmarried taxpayer

Q107: Rita, a single employee with AGI of

Q116: H (age 50)and W (age 48)are married

Q119: Mirasol Corporation granted an incentive stock option

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents