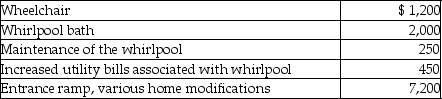

Alan, who is a security officer, is shot while on the job. As a result, Alan suffers from a chronic leg injury and must use a wheelchair and undergo therapy to regain and retain strength. Alan's physician recommends that he install a whirlpool bath in his home for therapy. During the year, Alan makes the following expenditures:  A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000. Alan's deductible medical expenses (before considering limitations based on AGI) will be

A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000. Alan's deductible medical expenses (before considering limitations based on AGI) will be

A) $6,000.

B) $10,100.

C) $7,000.

D) $7,700.

Correct Answer:

Verified

Q9: Leo spent $6,600 to construct an entrance

Q12: All of the following are deductible as

Q30: Linda had a swimming pool constructed at

Q31: The following taxes are deductible as itemized

Q46: Matt paid the following taxes in 2014:

Q48: Mr. and Mrs. Thibodeaux, who are filing

Q53: Mr. and Mrs. Gere, who are filing

Q55: Mitzi's medical expenses include the following:

Q56: Caleb's medical expenses before reimbursement for the

Q107: Legal fees for drafting a will are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents