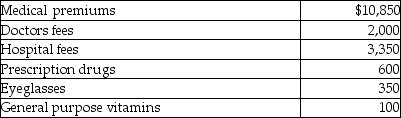

Mitzi's medical expenses include the following:  Mitzi's AGI for the year is $33,000. She is single and age 49. None of the medical costs are reimbursed by insurance. After considering the AGI floor, Mitzi's medical expense deduction is

Mitzi's AGI for the year is $33,000. She is single and age 49. None of the medical costs are reimbursed by insurance. After considering the AGI floor, Mitzi's medical expense deduction is

A) $12,900.

B) $13,850.

C) $14,675.

D) $16,325.

Correct Answer:

Verified

Q9: Leo spent $6,600 to construct an entrance

Q30: Linda had a swimming pool constructed at

Q41: In 2014,Carlos filed his 2013 state income

Q49: In February of the current year (assume

Q51: Alan, who is a security officer, is

Q53: Mr. and Mrs. Gere, who are filing

Q56: Caleb's medical expenses before reimbursement for the

Q60: A review of the 2014 tax file

Q103: A taxpayer can deduct a reasonable amount

Q107: Legal fees for drafting a will are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents