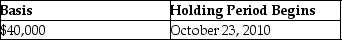

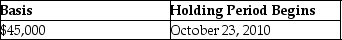

On April 4, 2014, Joan contributes business equipment (she had purchased on October 23, 2010) having a $45,000 FMV and a $40,000 adjusted basis to the EJK Partnership in exchange for a 25% interest in the capital and profits. The basis of the property and the date the holding period begins for the partnership is

A)

B)

C)

D)

Correct Answer:

Verified

Q44: On July 1,Alexandra contributes business equipment (which

Q54: Scott provides accounting services worth $40,000 to

Q54: Lance transferred land having a $180,000 FMV

Q60: John contributes land having $110,000 FMV and

Q61: In the syndication of a partnership,brokerage and

Q62: Joey and Bob each have 50% interest

Q64: Clark and Lois formed an equal partnership

Q67: Martha transferred property with a FMV of

Q76: Richard has a 50% interest in a

Q89: Jamahl has a 65% interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents