Joey and Bob each have 50% interest in a Partnership. Both Joey and the partnership file returns on a calendar year basis. Partnership Q had a $12,000 loss in 2014. Joey's adjusted basis in his partnership interest on January 1, 2014 was $5,000. In 2015, the partnership had a profit of $10,000. Assuming there were no other adjustments to Joey's basis in the partnership, what amount of partnership income (loss) should Joey show on his 2014 and 2015 individual income tax returns?

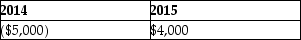

A)

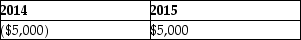

B)

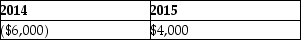

C)

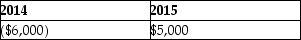

D)

Correct Answer:

Verified

Q44: On July 1,Alexandra contributes business equipment (which

Q54: Scott provides accounting services worth $40,000 to

Q54: Lance transferred land having a $180,000 FMV

Q58: Emma contributes property having a $24,000 FMV

Q60: John contributes land having $110,000 FMV and

Q61: In the syndication of a partnership,brokerage and

Q63: On April 4, 2014, Joan contributes business

Q64: Clark and Lois formed an equal partnership

Q76: Richard has a 50% interest in a

Q89: Jamahl has a 65% interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents