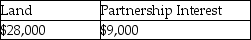

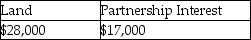

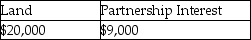

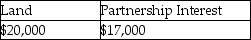

Atiqa receives a nonliquidating distribution of land from her partnership. The partnership purchased the land five years ago for $20,000. At the time of the distribution, it is worth $28,000. Prior to the distribution, Atiqa's basis in her partnership interest is $37,000. Atiqa's basis in the distributed land and her post-distribution basis in her partnership interest are:

A)

B)

C)

D)

Correct Answer:

Verified

Q82: Atiqa receives a nonliquidating distribution of land

Q84: Stephanie owns a 25% interest in a

Q85: Raina owns 100% of Tribo Inc., an

Q86: Which of the following statements regarding the

Q88: On July 1,Joseph,a 10% owner,sells his interest

Q89: Tony is the 100% shareholder of a

Q91: On January 1 of this year (assume

Q92: Ariel receives from her partnership a nonliquidating

Q96: Which of the following assets may cause

Q126: Stephanie owns a 25% interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents