Ariel receives from her partnership a nonliquidating distribution of $9,000 cash plus a parcel of land. The partnership had purchased the land five years ago for $20,000, but it is worth $28,000 at the time of the distribution. Ariel's predistribution basis is $17,000. How much income will Ariel recognize due to the distribution, and what is her basis in the land?

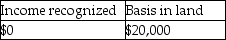

A)

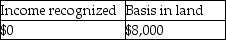

B)

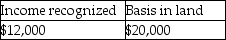

C)

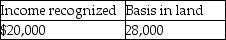

D)

Correct Answer:

Verified

Q78: All of the following statements are true

Q84: Brittany receives a nonliquidating distribution of $48,000

Q85: Which of the following is not a

Q87: Atiqa receives a nonliquidating distribution of land

Q89: Tony is the 100% shareholder of a

Q91: On January 1 of this year (assume

Q91: How does an electing large partnership differ

Q96: Which of the following assets may cause

Q126: Stephanie owns a 25% interest in a

Q133: All of the following would reduce the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents