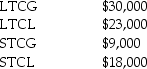

Small Corporation had the following capital gains and losses during the current year:

Taxable income, exclusive of the capital gains and losses above, is $68,000.

Taxable income, exclusive of the capital gains and losses above, is $68,000.

a. How should the capital gains and losses be treated for the current year?

b. What is the taxable income for the current year taking into consideration the capital gains and losses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Trestle Corp.received $100,000 of dividend income from

Q68: Individuals Gayle and Marcus form GM Corporation.Gayle

Q85: Johnson Corporation has $300,000 of AMTI before

Q101: Hazel Corporation reported the following results for

Q102: Star Corporation makes a liquidating distribution of

Q109: Bartlett Corporation, a U.S. manufacturer, reports the

Q119: Total Corporation has earned $75,000 current E&P

Q121: Which corporations are required to file a

Q122: Which of the following statements regarding corporate

Q127: A liquidating corporation

A)recognizes gains and losses on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents