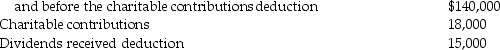

Hazel Corporation reported the following results for the current year:

Taxable income before the dividends-received deduction

What is the amount of the taxable income for the current year and what is the amount of the charitable contributions carryover to next year?

What is the amount of the taxable income for the current year and what is the amount of the charitable contributions carryover to next year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Trestle Corp.received $100,000 of dividend income from

Q66: Individuals Rhett and Scarlet form Lady Corporation.Rhett

Q68: Individuals Gayle and Marcus form GM Corporation.Gayle

Q70: Individuals Bert and Tariq form Shark Corporation.Bert

Q85: Johnson Corporation has $300,000 of AMTI before

Q102: Star Corporation makes a liquidating distribution of

Q104: Small Corporation had the following capital gains

Q114: John transfers assets with a $200,000 FMV

Q119: Total Corporation has earned $75,000 current E&P

Q121: Which corporations are required to file a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents