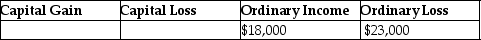

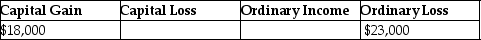

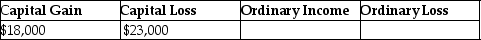

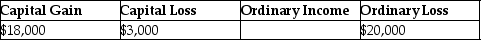

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses. The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Q18: Pierce has a $16,000 Section 1231 loss,a

Q20: During the current year,Danika recognizes a $30,000

Q21: Daniel recognizes $35,000 of Sec. 1231 gains

Q51: The amount recaptured as ordinary income under

Q65: When appreciated property is transferred at death,the

Q68: When a donee disposes of appreciated gift

Q80: The additional recapture under Sec.291 is 25%

Q81: Costs of tangible personal business property which

Q87: When gain is recognized on an involuntary

Q93: If no gain is recognized in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents