Daniel recognizes $35,000 of Sec. 1231 gains and $25,000 of Sec. 1231 losses during the current year. The only other Sec. 1231 item was a $4,000 loss three years ago. This year, Daniel must report

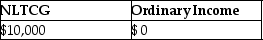

A)

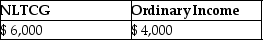

B)

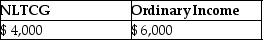

C)

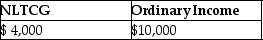

D)

Correct Answer:

Verified

Q5: A net Sec.1231 gain is treated as

Q9: Mark owns an unincorporated business and has

Q12: Sec.1231 property must satisfy a holding period

Q15: Gains and losses from involuntary conversions of

Q26: Jeremy has $18,000 of Section 1231 gains

Q39: The purpose of Sec.1245 is to eliminate

Q51: The amount recaptured as ordinary income under

Q80: The additional recapture under Sec.291 is 25%

Q81: Costs of tangible personal business property which

Q87: When gain is recognized on an involuntary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents