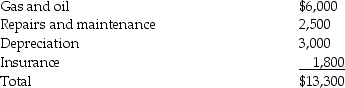

Sarah purchased a new car at the beginning of the year. She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile) reimbursement in 2015 for employment-related business miles. She incurs the following expenses related to both business and personal use:  She also spent $200 on parking and tolls that were related to business. During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business. During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: If an employee incurs travel expenditures and

Q34: An employer adopts a per diem policy

Q37: A taxpayer goes out of town to

Q43: If an employee incurs business-related entertainment expenses

Q47: "Associated with" entertainment expenditures generally must occur

Q48: Austin incurs $3,600 for business meals while

Q50: Clarissa is a very successful real estate

Q50: Steven is a representative for a textbook

Q53: Self-employed individuals receive a for AGI deduction

Q58: Matt is a sales representative for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents