Austin incurs $3,600 for business meals while traveling for his employer, Tex, Inc. Austin is reimbursed in full by Tex pursuant to an accountable plan. What amounts can Austin and Tex deduct?

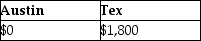

A)

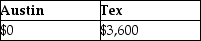

B)

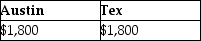

C)

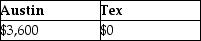

D)

Correct Answer:

Verified

Q34: An employer adopts a per diem policy

Q37: A taxpayer goes out of town to

Q46: Sarah purchased a new car at the

Q47: "Associated with" entertainment expenditures generally must occur

Q50: Clarissa is a very successful real estate

Q50: Steven is a representative for a textbook

Q53: Self-employed individuals receive a for AGI deduction

Q58: Matt is a sales representative for a

Q59: An accountant takes her client to a

Q60: Sarah incurred employee business expenses of $5,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents