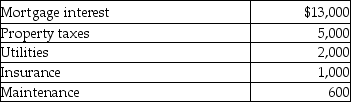

Ola owns a cottage at the beach. She and her family use the property for 30 days during the summer season and rent it to unrelated parties for 60 days. The rental receipts amount to $8,000. Total costs of operating the property are as follows:  In addition, potential depreciation expense is $9,000.

In addition, potential depreciation expense is $9,000.

a. Is the cottage subject to the vacation home rental limitations of IRC Sec. 280A?

b. How much of expenses can Ola deduct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: Anita has decided to sell a parcel

Q126: Brent must substantiate his travel and entertainment

Q127: Tess has started a new part-time business.She

Q131: During the current year, Paul, a single

Q134: Lindsey Forbes, a detective who is single,

Q135: Mackensie owns a condominium in the Rocky

Q136: Margaret, a single taxpayer, operates a small

Q481: Diane, a successful accountant with an annual

Q486: Explain the rules for determining whether a

Q497: Discuss tax planning considerations which a taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents