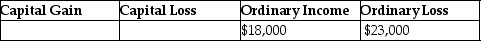

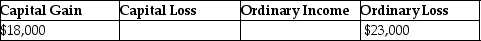

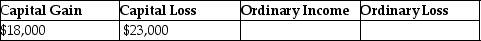

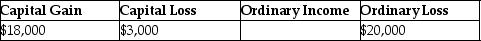

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses. The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Q3: During the current year,George recognizes a $30,000

Q5: A net Sec.1231 gain is treated as

Q10: Yelenis, whose tax rate is 28%, sells

Q13: Lucy, a noncorporate taxpayer, experienced the following

Q13: Why did Congress establish favorable treatment for

Q15: Daniel recognizes $35,000 of Sec. 1231 gains

Q16: Aamir has $25,000 of net Sec.1231 gains

Q18: Pierce has a $16,000 Section 1231 loss,a

Q19: Mark owns an unincorporated business and has

Q20: During the current year,Danika recognizes a $30,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents