Yelenis, whose tax rate is 28%, sells one Sec. 1231 asset this year, resulting in a $50,000 gain. Included in the $50,000 Sec. 1231 gain is $30,000 of unrecaptured Sec. 1250 gain. A review of Yelenis tax files for the past five years indicates one prior Sec. 1231 sale which resulted in a $14,000 loss. The gain will be taxed as

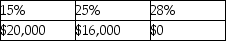

A)

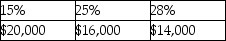

B)

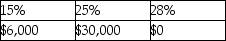

C)

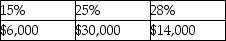

D)

Correct Answer:

Verified

Q2: Hilton,a single taxpayer in the 28% marginal

Q5: A net Sec.1231 gain is treated as

Q7: Jillian,whose tax rate is 39.6%,had the following

Q12: Sec.1231 property must satisfy a holding period

Q13: Why did Congress establish favorable treatment for

Q13: Lucy, a noncorporate taxpayer, experienced the following

Q14: Jeremy has $18,000 of Section 1231 gains

Q15: Daniel recognizes $35,000 of Sec. 1231 gains

Q16: Any gain or loss resulting from the

Q19: Mark owns an unincorporated business and has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents