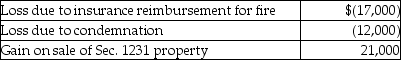

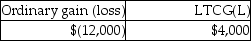

This year Jenna had the gains and losses noted below on property, plant and equipment used in her business. Each asset had been held longer than one year. Jenna has not previously disposed of any business assets.  Jenna will recognize

Jenna will recognize

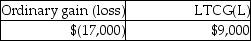

A)

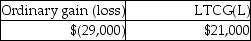

B)

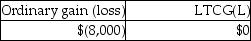

C)

D)

Correct Answer:

Verified

Q27: If the accumulated depreciation on business equipment

Q39: The purpose of Sec.1245 is to eliminate

Q43: Sec.1245 ordinary income recapture can apply to

Q46: Network Corporation purchased $200,000 of five-year equipment

Q49: Sec.1245 applies to gains on the sale

Q52: When corporate and noncorporate taxpayers sell real

Q53: The following gains and losses pertain to

Q54: Section 1245 recapture applies to all the

Q57: The following are gains and losses recognized

Q59: During the current year,Hugo sells equipment for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents