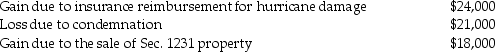

The following gains and losses pertain to Jimmy's business assets that qualify as Sec. 1231 property. Jimmy does not have any nonrecaptured net Sec. 1231 losses from previous years, and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.  Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: The purpose of Sec.1245 is to eliminate

Q43: Sec.1245 ordinary income recapture can apply to

Q46: Network Corporation purchased $200,000 of five-year equipment

Q48: The following gains and losses pertain to

Q49: An unincorporated business sold two warehouses during

Q54: Section 1245 recapture applies to all the

Q56: This year Jenna had the gains and

Q57: If a taxpayer has gains on Sec.1231

Q57: The following are gains and losses recognized

Q59: During the current year,Hugo sells equipment for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents