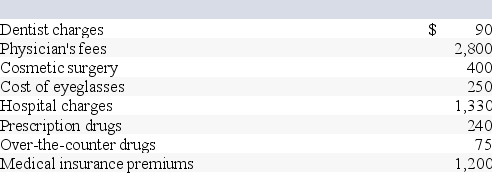

Jenna (age 50)files single and reports AGI of $40,000.This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Correct Answer:

Verified

All expenses are qualified medic...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Andres and Lakeisha are married and file

Q41: Chuck has AGI of $70,000 and has

Q42: Karin and Chad (ages 30 and 31,

Q43: Don's personal auto was damaged in a

Q44: Detmer is a successful doctor who earned

Q46: Campbell, a single taxpayer, has $400,000 of

Q47: Erika (age 62)was hospitalized with injuries from

Q48: This year Latrell made the following charitable

Q49: Misti purchased a residence this year.Misti, age

Q50: Jon and Holly are married and live

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents