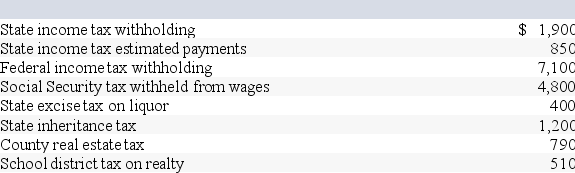

Chuck has AGI of $70,000 and has made the following payments this tax year:

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: This year Amanda paid $749 in federal

Q39: Which of the following is a deductible

Q40: Andres and Lakeisha are married and file

Q42: Karin and Chad (ages 30 and 31,

Q43: Don's personal auto was damaged in a

Q44: Detmer is a successful doctor who earned

Q45: Jenna (age 50)files single and reports AGI

Q46: Campbell, a single taxpayer, has $400,000 of

Q76: When taxpayers donate cash and capital gain

Q78: Larry recorded the following donations this year:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents