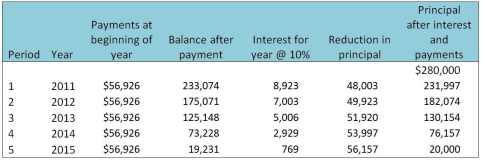

The following amortization schedule is for a lease entered into at the start of fiscal 2011 for an asset that will be useful for 5 years.The company uses straight-line depreciation method.

Required:

Required:

Provide the appropriate presentation of this lease in the lessee's balance sheet for December 31,2012,distinguishing amounts that are current from those that are non-current.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: The following amortization schedule is for a

Q86: On April 1,2012,Janus Company entered into a

Q87: On January 1,2011,Sheldon Company sold a building

Q88: On January 1,2011,Teddy Company sold a building

Q89: On April 1,2012,Helo Company entered into a

Q90: Viribana Corporation started operations on March I,2009.It

Q91: Kartik Corporation started operations on March I,2009.It

Q92: Curtis Corporation started operations on March I,2009.It

Q93: Boris Corporation started operations on March I,2009.It

Q94: On January 1,2011,Cory Company sold a building

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents