Nicholas, a 40% partner in Nedeau Partnership, gives one-half of his interest to his sister, Michelle. During the current year, Nicholas performs services for the partnership for which reasonable compensation is $80,000, but for which he accepts no pay. Nicholas and Michelle are each credited with a $100,000 distributive share, all of which is ordinary income. What are Nicholas' and Michelle's distributive share?

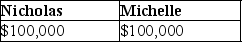

A)

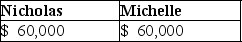

B)

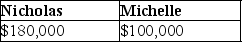

C)

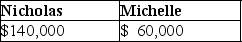

D)

Correct Answer:

Verified

Q101: What is the tax impact of guaranteed

Q104: When determining the guaranteed payment, which of

Q106: Brent is a limited partner in BC

Q106: In January of this year, Arkeva, a

Q107: Janice has a 30% interest in the

Q110: Bud has devoted his life to his

Q111: Edward owns a 70% interest in the

Q113: Yee manages Huang real estate, a partnership

Q114: Yee manages Huang real estate, a partnership

Q114: In January, Daryl and Louis form a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents