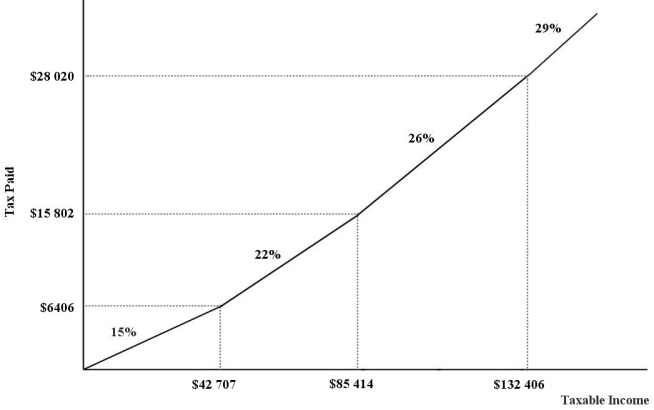

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2.An individual with a taxable income of $39 500 will pay in income taxes.

A) $5925

B) $8690

C) $6122

D) $0

E) $6109

Correct Answer:

Verified

Q24: In Canada,post- secondary education is

A)a provincial responsibility,funded

Q25: The diagram below shows supply and demand

Q26: The federal corporate income tax in Canada

Q27: In Canada,students' tuition fees for post- secondary

Q28: Consider two families,each of whom earn total

Q30: The table below shows 2012 federal

Q31: Tax and other revenues collected by all

Q32: The excess burden of an excise tax

A)is

Q33: An efficiency argument for public provision of

Q34: In Canada,publicly provided health care is

A)a provincial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents