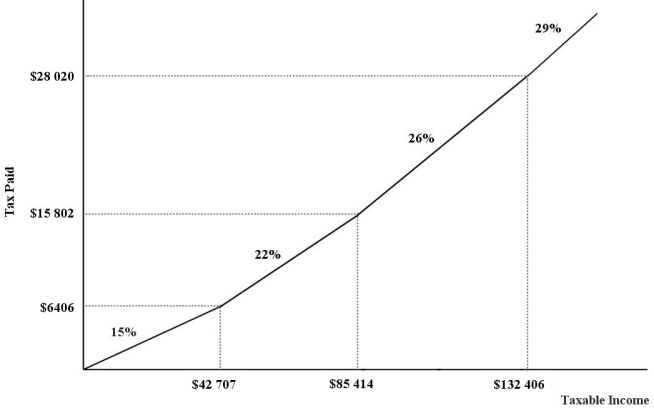

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Suppose taxes are levied in the following way.All individuals pay a tax equal to $2000 no matter what income they earn.In addition,all individuals pay 20% of all their earned income in taxes.This income- tax system is

A) indexed.

B) progressive.

C) regressive.

D) an accurate description of the Canadian system.

E) proportional.

Correct Answer:

Verified

Q39: One of the guiding principles in Canada's

Q40: The diagram below shows supply and demand

Q41: Consider a monopolist that is earning profits

Q42: Consider an income- tax system that requires

Q43: Suppose an additional "special" tax of $0.10

Q45: The table below shows 2012 federal

Q46: The excess burden of a tax reflects

Q47: The Canada Health Transfer (CHT)and the Canada

Q48: The Canada (and Quebec)Pension Plans (CPP and

Q49: Consider the concept of equity in taxation.What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents