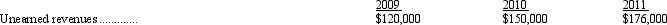

Barker, Inc. receives subscription payments for annual (one year) subscriptions to its magazine. Payments are recorded as revenue when received. Amounts received but unearned at the end of each of the last three years are shown below.

Barker failed to record the unearned revenues in each of the three years. The entry needed to correct the above errors is

A) Retained Earnings .................. 150,000 Subscription Revenues .............. 26,000

Unearned Revenues ............... 176,000

B) Retained Earnings .................. 30,000 Subscription Revenues .............. 26,000

Unearned Revenues ............... 56,000

C) Subscription Revenues .............. 176,000 Unearned Revenues ............... 176,000

D) Subscription Revenues .............. 150,000 Retained Earnings .................. 26,000

Unearned Revenues ............... 176,000

Correct Answer:

Verified

Q22: Which of the following statements is not

Q33: On January 1, 2008, Grayson Company purchased

Q35: Coombs, Inc. is a calendar-year corporation whose

Q36: Kentucky Enterprises purchased a machine on January

Q37: Badger Corporation purchased a machine for $150,000

Q37: A change from an accelerated depreciation method

Q40: On December 31, 2011, Buckeye Corporation appropriately

Q41: Ending inventory for 2009 is overstated by

Q43: If, at the end of a period,

Q67: For a company with a periodic inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents