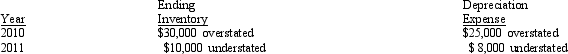

Coombs, Inc. is a calendar-year corporation whose financial statements for 2010 and 2011 included errors as follows:

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2010, or December 31, 2011. Ignoring income taxes, by how much should Coombs's retained earnings be retroactively adjusted at January 1, 2012?

A) $27,000 increase

B) $27,000 decrease

C) $7,000 decrease

D) $3,000 decrease

Correct Answer:

Verified

Q22: Which of the following statements is not

Q30: Rodney Company's December 31 year-end financial statements

Q31: Koppell Co. made the following errors in

Q32: Biden Corp. reports on a calendar-year basis.

Q33: On January 1, 2008, Grayson Company purchased

Q36: Kentucky Enterprises purchased a machine on January

Q37: Badger Corporation purchased a machine for $150,000

Q37: A change from an accelerated depreciation method

Q38: Barker, Inc. receives subscription payments for annual

Q40: On December 31, 2011, Buckeye Corporation appropriately

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents