Hearsa Manufacturing Inc. purchased a new machine on January 2, 2011, that was built to perform one function on its assembly line. Data pertaining to this machine are:

Acquisition cost $330,000

Residual value $30,000

Estimated service life:

Years 5

Service hours 250,000

Production output 300,000

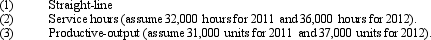

Using each of the following methods, compute the annual depreciation rate and charge for the years ended December 31, 2011, and 2012:

Correct Answer:

Verified

Q74: In 2010, Silverspur Mining Inc. purchased land

Q75: Bellows Bottling purchased for $800,000 a trademark

Q76: Seaver Inc. exchanged a machine costing $400,000

Q77: Johnson Company is located in Hong Kong

Q78: The Chase Company exchanged equipment costing $240,000

Q79: The Fitzsimmons Company applied for and received

Q81: WM is a waste disposal company. Explain

Q82: Wilbur Company acquired Smith Company on January

Q83: Depreciation is the systematic allocation of historical

Q84: Use-factor depreciation methods view asset consumption as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents