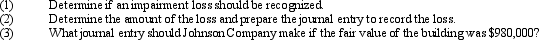

Johnson Company is located in Hong Kong and uses international accounting standards. Johnson Company purchased equipment 8 years ago for $1,000,000. The equipment has been depreciated using the straight-line method with a 20-year useful life and 10% residual value. Johnson's operations have experienced significant losses for the past 2 years and, as a result, the company has decided that the equipment should be evaluated for possible impairment. The management of Johnson Company estimates that the equipment has a remaining useful life of 7 years. The discounted value of the future net cash inflows from the use of the equipment is $220,000. The fair value of the equipment is $240,000. No goodwill was associated with the purchase of the equipment. Johnson Company has chosen to recognize increases in the value of long-term operating assets in accordance with the allowable alternative under IAS 36.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Five years ago, Goodman, Inc., purchased a

Q74: In 2010, Silverspur Mining Inc. purchased land

Q75: Bellows Bottling purchased for $800,000 a trademark

Q76: Seaver Inc. exchanged a machine costing $400,000

Q78: Which of the following represents the maximum

Q78: The Chase Company exchanged equipment costing $240,000

Q79: The Fitzsimmons Company applied for and received

Q80: Hearsa Manufacturing Inc. purchased a new machine

Q81: WM is a waste disposal company. Explain

Q82: Wilbur Company acquired Smith Company on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents